Mobility is essential to economic and social development as it enables access to goods, services, and information, as well as jobs, markets, family, and friends. But it remains a major challenge for inter-African trade and productivity.

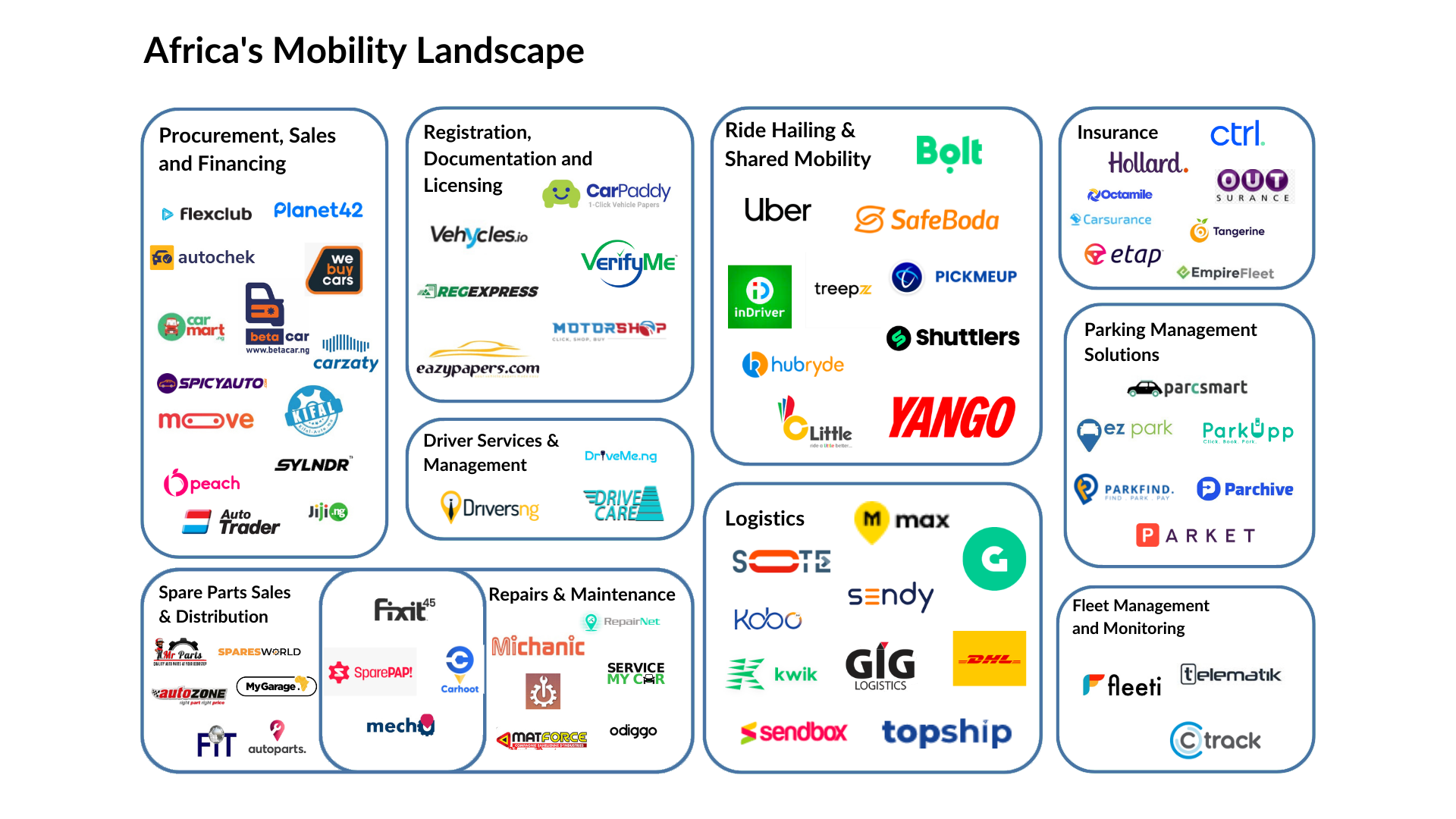

Below is a map of key areas of startup activity across Africa’s mobility sector, including a non-exhaustive set of the most prominent startups in each area. As vehicle ownership deepens, ride-hailing services expand, and trucking solutions penetrate, the need for a vibrant servicing and support industry emerges.

Among the various sub-verticals, Procurement, Sales, and Financing has seen the most activity so far, with Moove raising mega-rounds to provide Uber drivers with vehicle financing through their revenue sharing model and Autochek rapidly expanding across markets through acquisitions, aggregating dealerships and providing financing for customers. Companies like Mecho are catering to the service industry, providing on-demand repair services coupled with spare parts distribution, and newer models are focusing on making documentation and licensing easier.

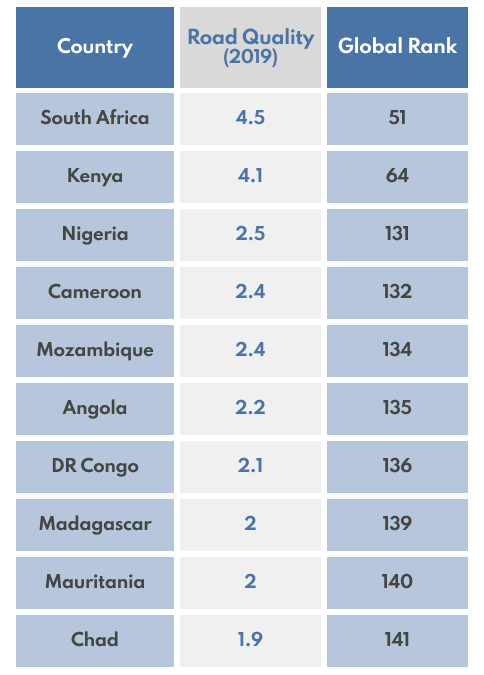

However, as low purchasing power coupled with a burgeoning population keeps driving demand for pre-owned vehicles across the continent, the spare parts market becomes even more pertinent than the market for vehicles. Also, African countries tend to rank poorly in road quality, leading to more vehicular incidents, reduced expected vehicle life, and ultimately an increased need for replacement parts across the continent. But these spare parts can be expensive and hard to find.

These and other catalysts create an opportunity for companies to penetrate and disrupt the spare parts landscape. Having examined a variety of business models in this industry, here are insights that will prove useful to innovators building for the spare parts market:

a. The informal spare parts market is made up of family-run businesses

Africa’s automotive sales and aftermarket industry is peculiar in that it is dominated by businesses that are often family owned and passed on from generation to generation — along with connections and business secrets. Car dealers have consortiums where they operate their backend as an organized group, and spare parts vendors have long-standing suppliers they’ve worked with for years helping to manage their pricing. The typical mid- to large-scale spare parts vendor is a middle-aged, semi-educated man managing operations with 2 or more apprentices (often relatives) helping out with day-to-day activities.

The majority of business owners in the industry have access to smartphones and mobile devices, and even computers. The apprentices and staff are generally internet savvy and the owners are quite open to tools that can help make operations more transparent and efficient so they don’t get cheated by staff. This presents an opportunity for the vertical to be digitized.

b. Inventory management is painfully manual with stock susceptible to obsoletion

Imported or otherwise procured spare parts are offloaded batch-by-batch and stored in warehouses with generally little stock taking, which makes items susceptible to theft. Inventory requirements are largely determined by applying rules of thumb unsupported by rigorous data and forecasting. Any items left unsold continue accumulating warehouse and storage costs and the importer continues to stockpile and import more goods.

While spare parts have no specified expiration date, they are susceptible to obsoletion. Conversations with vendors indicate that stocking inventory that is over ten years old is not at all uncommon. And as inventory ages and salespeople come and go, chances are that the existence of old stock is forgotten, ultimately resulting in losses.

c. Distribution is still mostly offline and inadequate

Although the auto sales and aftermarket opportunity is huge, fragmentation across various brands/distributors is an obstacle. Spare parts sales are still largely offline, and no well-developed distribution networks have been put in place to ensure part availability, especially outside of urban areas.

Vendors typically carry a wide range of stock depending on what parts and brands they specialise in — from engines to bumpers to tires. Distribution is mostly inhouse and through classified marketplaces, limiting their reach.

d. Specialisation can help boost mechanics’ operations

It’s common to see mechanics specialize in certain vehicle makes and models. However, there are a number of generalists who tend to use trial and error methods that sometimes lead to problems worse than the original faults. Specialist typically take less time to fix a car, deliver better results, and are more likely to source parts more efficiently.

Roadside mechanics and technicians often complain about the time it takes to go to market to find a part, bring it back, test it for fit and authenticity, and then return it if it doesn’t meet requirements. The majority of these mechanics don’t have the capital to keep stock on hand and have to venture to markets and back to buy parts on demand. There are large gains to be made here from specialization and organized distribution as the time it takes to source the right parts can be reduced and parts can easily be delivered (and returned if need be). And in the long run, financing products can be built to help mechanics keep popular stock items on hand, improving their bottom line.

e. Margins are contracted due to fragmentation of the distribution chain

Despite the volumes the African spare parts market does, vendors still often have to source from distributors as opposed to manufacturers. The range of stock carried by a wide spread of small- to medium-scale businesses, while vast, isn’t enough to establish clear and predictable market demand. This absence of demand data results in dead stock which in turn drives prices up as vendors make their margins across all goods.

Aggregating purchasing power to achieve the volumes necessary to source parts directly from manufacturers could help drive down price and increase margins. It’s also a long term source of aggregated data that is valuable for supply planning. Successful parallels exist with companies like TopUp Mama aggregating for restaurants, and Marketforce & TradeDepot doing the same for FMCG retailers.

Building for the next stage of the spare parts supply chain

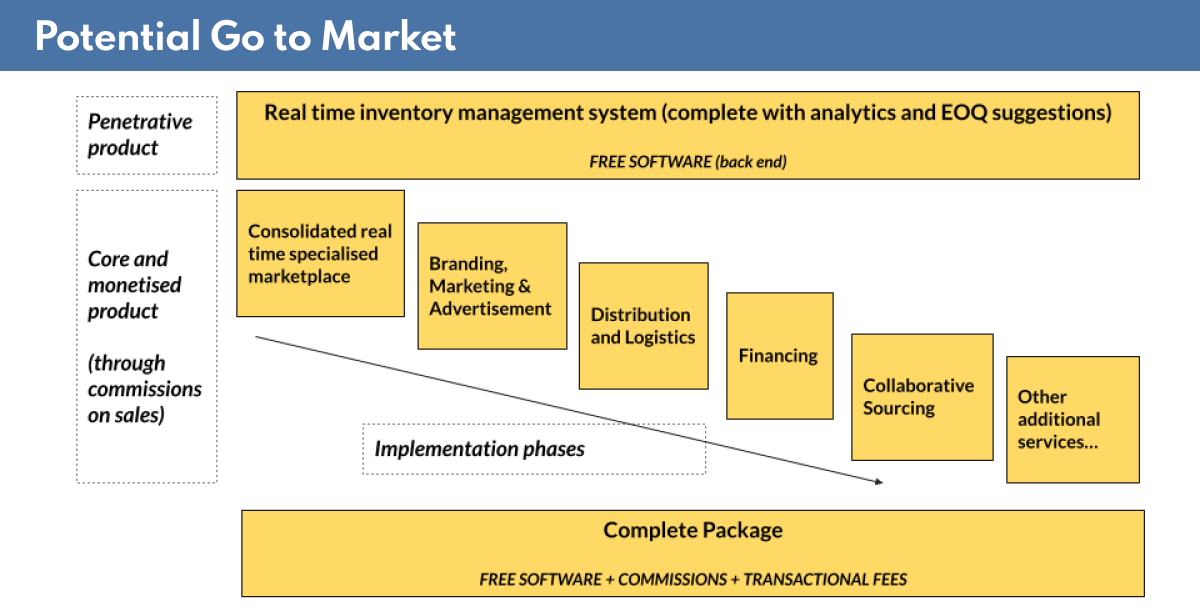

There’s a billion dollar opportunity in providing enabling digital infrastructure for the offline spare parts market through consolidated inventory management systems.

One option is to build a reliable spare parts supplier with omni channel distribution to meet and manage mechanics where they are. Because of how fragmented the market is, one viable strategy would be to gain market share by distributing the most commonly replaced parts, providing a one-stop sourcing platform for mechanics. Authenticity & trust would be the name of the game here which would help minimize spare part returns from mechanics and go a long way towards building a brand which will then help with expansion.

Another option is to partner with incumbents to digitize their stock, make it transparent and accessible, and add convenient delivery methods via partnerships. Attempting to penetrate the spare parts market by competing directly with incumbents will require a large amount of capital and these incumbents have deep roots in the market and the loyalty of a vast number of service market participants (i.e., informal technicians). In contrast, this approach would enable small scale spare parts retailers and distributors to sell their stock and reduce working capital while offering a convenient path for mechanics to find and access the stock on the other end.

The future is bright for companies that build out aggregation systems to formalize this industry, going beyond just websites for sales to systems for inventory management. This relies, as a first step, on software and systems being able to properly identify and record spare parts SKUs and products, which leads to real time visibility into who owns and holds what and provides valuable data for minimization of distribution costs. Concentrated and unified branding efforts will create a positive flywheel aiding additional offerings.

In the long run here, there’s a full blown data play to meet the needs of each segment.

- Car owners gain transparency as they can compare pricing and grades for the replacement parts they’ve been told that their car needs.

- Vendors gain insight into where customers are concentrated, directing them to where they can set up shop next and what brands need parts replaced more often than others, helping them scale.

- More widely, robust data can provide concrete evidence showing where large scale car manufacturers should launch production/assembly plants on the continent for the most value.

- And local manufacturers will be able to focus their efforts on the fastest moving and highest yielding parts, helping their bottom line and allowing them to invest in new technology that makes production of these parts cheaper and more efficient.

Africa has more than a billion people — 17% of the world’s population — but accounts for only 1% of cars sold worldwide. The automobile industry has the capacity to create value and jobs and can unlock development opportunities for the continent.

Given the current growth and innovation we are beginning to see with vehicle penetration on the continent, the opportunities in organizing the spare parts and servicing market is significant.

A version of this article first appeared on the Future Africa blog.

Share: